Gamifying Finance Tracking for Young Couples

CLIENT

Institute of Systems Research (ISR), University of Maryland

ROLE

UX Researcher, UX Designer

TOOLS

Figma, Miro, Zoom

BRIEF

I collaborated with a group of six students to examine the financial management habits and worries of graduate students, especially those who are married or in a relationship.

WHAT WE DID

We carried out qualitative research on student behaviors and I designed a solution based on the insights we gathered.

POTENTIAL RESULT

-

Enhancing financial literacy among partners.

-

Promotes better collaboration and fosters trust in managing finances.

CONTEXT

Our client, Dr. Wayne Phoel, a visiting research engineer at ISR, is spearheading research in financial technology aimed at generating potential product concepts to enhance financial decision-making. Many students encounter difficulties in managing their finances due to a lack of financial literacy, restricted incomes, and the intricacies of budgeting. There is a demand for a tool that streamlines financial monitoring and promotes cooperation with partners or families.

What are the key factors that impact the financial decisions of graduate students who are married or in a serious relationship?

Which aspects of relationships help students effectively manage their finances?

How can we help students improve their financial habits while managing family or partner responsibilities?

How did I work on this problem?

PROCESS

We tackled the task using Contextual Design principles. Through qualitative research methods, we delved deep into understanding how graduate students manage their finances.

Based on the research insight, We then analyzed the gathered data to uncover patterns, challenges, and opportunities concerning financial literacy among graduate students. We identified key features of a tool. I built on this information to design the tool. graduate students.

Research

Understand the graduate students needs and pains with finance management

Ideation

Brainstorm on ideas based on the research data

Design

Design the tool incorporating the insights

The first step was to recruit participants who would fall under the graduate student + living with partner/spouse category.

RESEARCH

We reached out to graduate students within our network, including friends, acquaintances, and roommates, who were willing to take part in our study. By posing two screening questions, we successfully found suitable participants and ultimately recruited 4 individuals for the research.

User Interviews

We conducted semi-structured interviews using contextual inquiry methods, following the master-apprentice model. I conducted and took notes in two interviews. This approach yielded valuable data based on their everyday actions and decisions.

Throughout the interviews, we delved into the participants' financial situation, how they discuss finances with their partners, and the tools or resources they utilize for financial management .

ANALYSIS

After our interpretation session, we used affinity mapping to analyze our data. We sorted the data into themes and insights, which revealed certain patterns and connections.

Insights from Affinity Mapping

The users shared their deepest insecurities and questions they had about financial matters, as well as insights into how they handle it with their partners. Here are some of their unfiltered thoughts.

"I want a digital financial tool that is worthwhile and convinient ."

"Graduate school has limited my finances and my ability to absorb unplanned expenses."

"My financial concerns are mitigated by current support and potential opportunties."

"I seek resources for financial information based on the trustworthiness of the source."

"Our shared approach to finances help us implement and maintain the budget."

"Our individual responsibility makes it easy for us to trust eachother in financial decision-making ."

" Communication is the key part of maintaining our finances together."

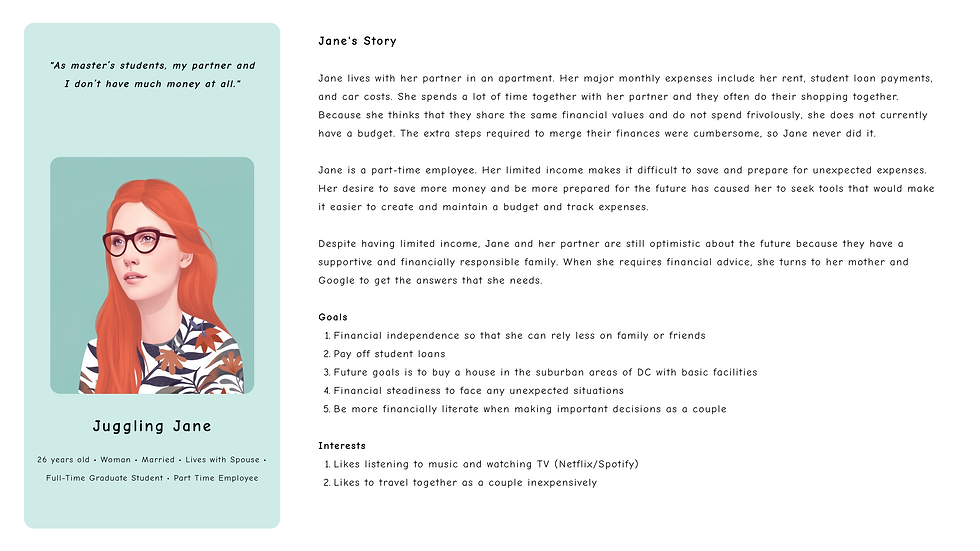

To gain a better understanding of their needs and facilitate the sharing of information with the client, we developed two personas. These personas encompass a wide range of financial goals, current financial behaviors, relationship dynamics, and other crucial aspects.

Based on the data analysis, we developed a model to understand our users' perspectives on financial matters more effectively.

The relationship model depicts the close inner circle of our user, Jane, with whom she openly discusses finances. The next circle consists of her friends and colleagues, and the outer circle comprises acquaintances. Our goal is to understand the importance of factors such as trust and confidentiality to Jane, and based on these considerations, we derived insights.

What did we learn from the research?

💰 CURRENT TIGHT FINANCIAL SITUATION

Many graduate students and their partners are balancing their studies while working part-time. With their combined income, they need a method to keep track of their shared expenses.

📚 LACKING IN FINANCIAL LITERACY

Many students do not know about the financial literacy resources that are available to them, but they are keen to enhance their knowledge of common financial topics, like interest rates and mortgages.

📢 MULTIPLE SOURCES OF INFORMATION SEEKING

Students seek financial advice from trusted, responsible, and experienced individuals in their lives, including partners, friends, and family. Trust is a key factor here.

💞 DECISION-MAKING WITH PARTNER

In general, students tend to have a trusting relationship with their partners when it comes to financial matters and strive to fairly divide financial responsibilities. This is influenced by factors such as income, occupation, age, and living arrangements. Additionally, effective communication plays a crucial role in sharing finances with your partner.

🛠️ DESIRE FOR CONVINIENT FINANCIAL TOOLS

For students, staying on top of expenses and bills can be tough. Many find it challenging to track their spending regularly. Although there are tools to help with this, they often don't provide much insight, especially for those managing family finances alone.

IDEATION

Next, we shifted from analyzing the data to brainstorming potential solutions for the issues discovered in our research. Drawing from the affinity diagram, we compiled a list of promising ideas to jumpstart the process. Furthermore, we documented probable concerns that users might face when using a financial tool.

I started my design process by combining collaborative goal tracking, gamification, and learning.

DESIGN

The app's design takes inspiration from games that utilize blocks as the main interaction method. To achieve a neon effect, I selected pastel colors. The visual components of the app strive to evoke a nostalgic gaming experience and provide visual feedback on expenditure.

I incorporated visual elements in my project that mimic real-life objects, such as video game controllers and pixel screens. To achieve a pixelated video game feel, I utilized grid elements in my background screens and in the game box.

The Solution

🎯 GAMIFY FINANCE TRACKING WITH PARTNER

A game experience with a vintage theme that effectively keeps users engaged and motivated while they track their financial habits.

🤝🏻 IMPROVES COLLABORATION WITH PARTNER

Builds trust and fosters better collaboration with partners to have a shared financial goal and a way to track household expenses together.

🔎 PROVIDES INSIGHTS ON EXPENDTITURE BASED ON CATEGORY

Users are able to access insights on expenses categorized by type and time, which helps them stay self-aware.

👩🏻💻 IMPROVES FINANCIAL KNOWLEDGE WITH REVIEW FEATURE

Monitor your spending patterns as a couple and get personalized advice for enhancing your financial habits.

THE PROTOTYPE

LEARNINGS

Improved my user research skills

I conducted my independent user interview in this project. Wearing the researcher hat was a valuable experience as it allowed me to gain insights into the users' needs.

Handling ambigious goals

Research can feel like a never-ending journey. At first, grasping our clients' needs was challenging, but we managed to pinpoint our goal, which allowed us to concentrate on our research more effectively.

Designing something unconventional

Balancing gamification and finance tracking in the design was quite challenging. There's definitely room for improvement.